Unboxing the Citi Prestige Card

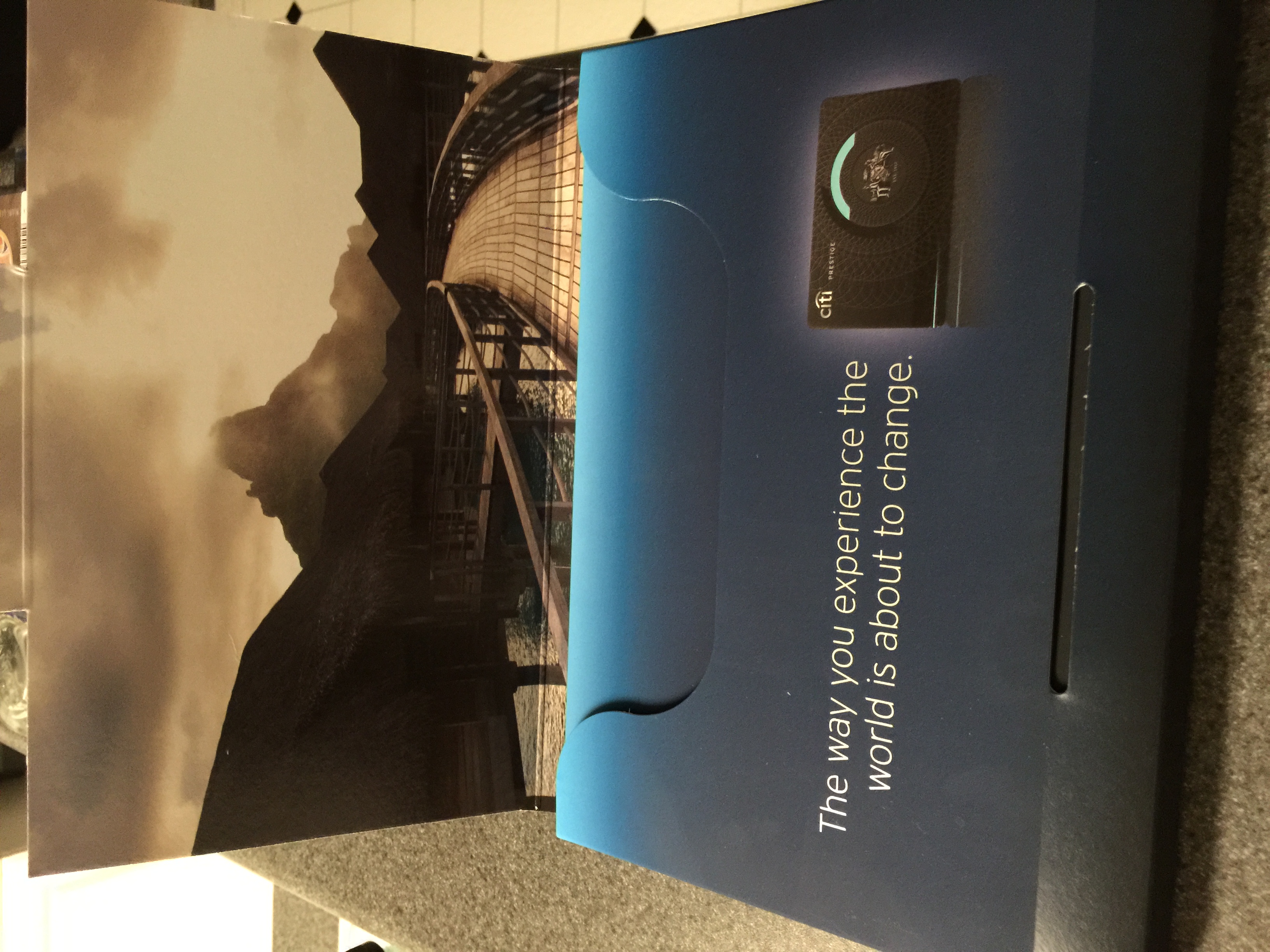

I have long watched videos and seen pictures online of the unboxing of various products, generally consumer electronics. I never thought I would unbox a credit card. That changed last week when my new Citi Prestige Card arrived. Apparently, when you sign up for a credit card that carries a $450 annual fee, it does not just show up in your mailbox in an undignified blank envelope. It arrives in an unmarked white box, delivered overnight by FedEx.

The Citi Prestige Card arrives overnight in a plain white box (click to enlarge)

Inside that innocuous white outer shell is a sleek black and blue box that might lead one to think that Jony Ive had taken his exquisite design skills from Apple to Citibank.

Opening the shipping package (click to enlarge)

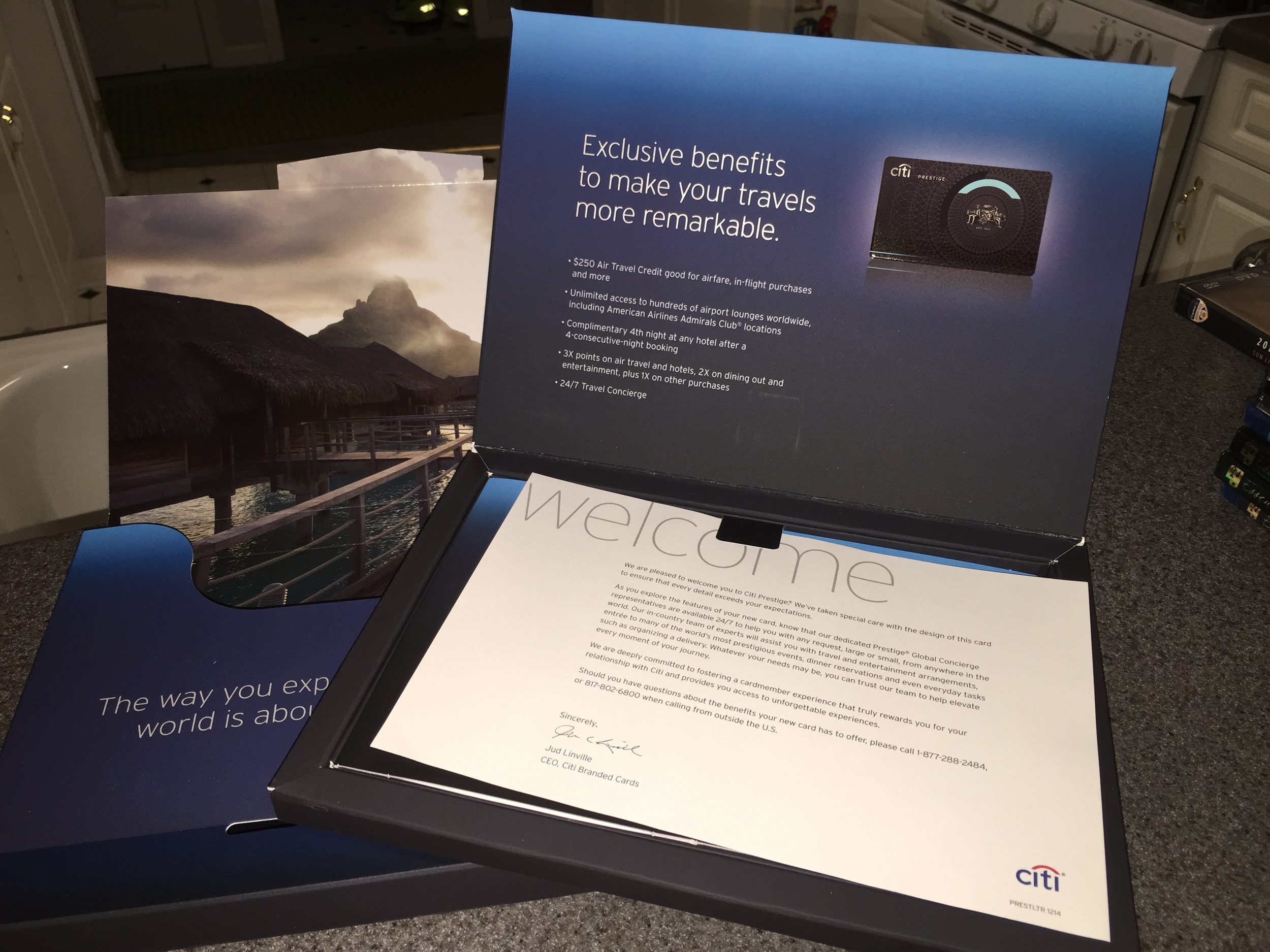

Inside, a similarly designed box flips open to reveal a tab and your card, paper work and a "Directory of Services" that would look at home in the documentation folder of a luxury automobile. The card terms and conditions, guide to protection and benefits are not printed on the same cheap, tissue-thin paper like most cards. The booklets have nice glossy covers and heavier paper.

Citi Prestige Card documentation (click to enlarge)

Citi Prestige Card documentation (click to enlarge)

The credit card itself is an elegant design in mostly black with only a gray graphic, a blue Citi arc logo and "Citi PRESTIGE" titling. It's design certainly compares favorably with the legendary American Express Centurion card, though the benefits and exclusivity fall far short of the famed "Black Card."

The Citi Prestige Card (click to enlarge)

The only complaint about the card itself is actually a result of the design. If you look closely, you can see the magnetic stripe on the front of the card. This has already confused the majority of cashiers that have swiped my new card. I love the look of the design and I know that as we transition to EMV credit card terminals, we will use the mag stripe less and less, but for now I have a bad feeling I will be telling many cashiers how to stripe a credit card.

With a $450 annual fee, will I renew the card for an additional year? We will have to see. Much of the value that the card offers and that justifies the annual fee is to be had in the first year (assuming you take advantage of those benefits). You must hold this card or the ThankYou Premier Card (offering a 50,000 point sign-up bonus as of today!) in order to transfer ThankYou Points for travel rewards, but the ThankYou Premier Card carries a much lower annual fee. That renewal decision is one I won't have to make for a year, so, for now, I am using my card and working on meeting my spend requirement in order to get those 50,000 bonus points.

Photo Gallery